does arizona have a solar tax credit

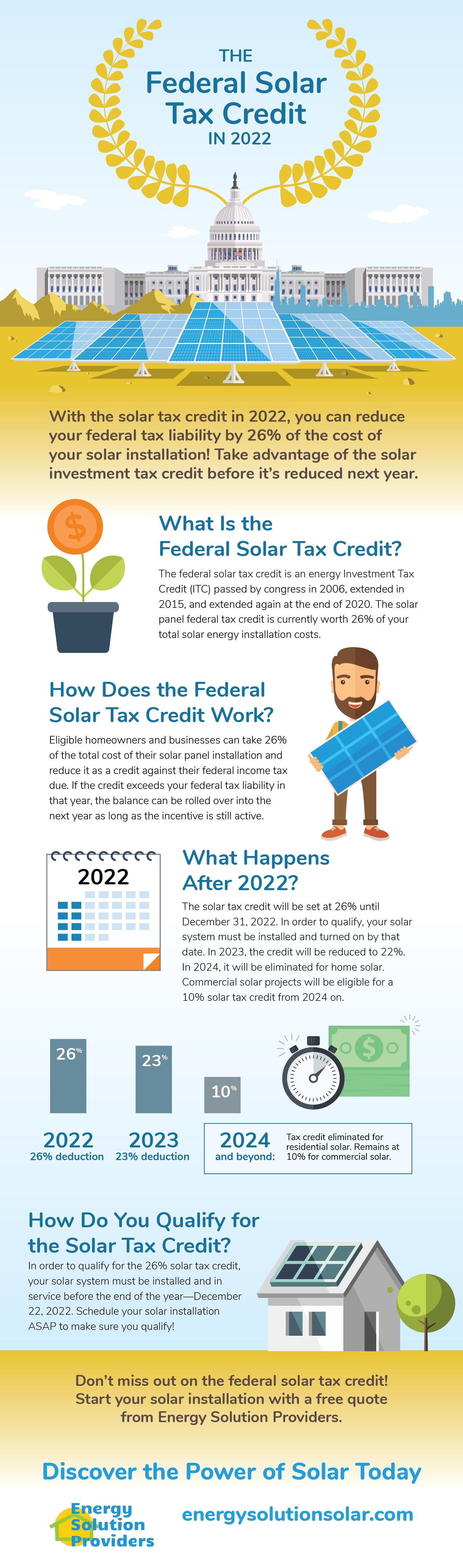

For example if your solar PV system was installed before December 31 2022 cost 18000 and your utility gave you a one-time rebate of 1000 for installing the system your tax credit would. The tax credit remains at 30 percent of the cost of the system.

Federal Solar Tax Credit A Homeowner S Guide 2022 Updated

Here are the specifics.

. Renewable Energy Production Tax Credit. The 26 solar tax credit is available. Arizona Credit for Solar Hot Water Heater Plumbing Stub Out and Electric Vehicle Charging Station Outlet.

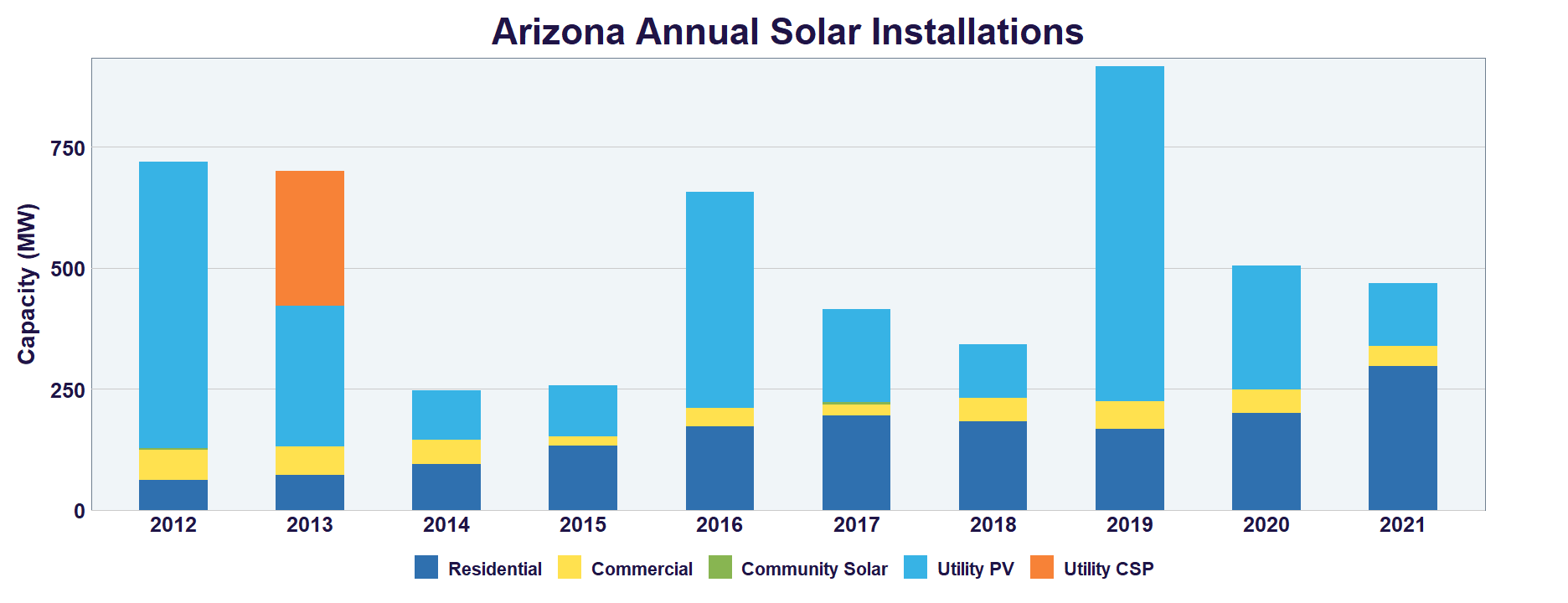

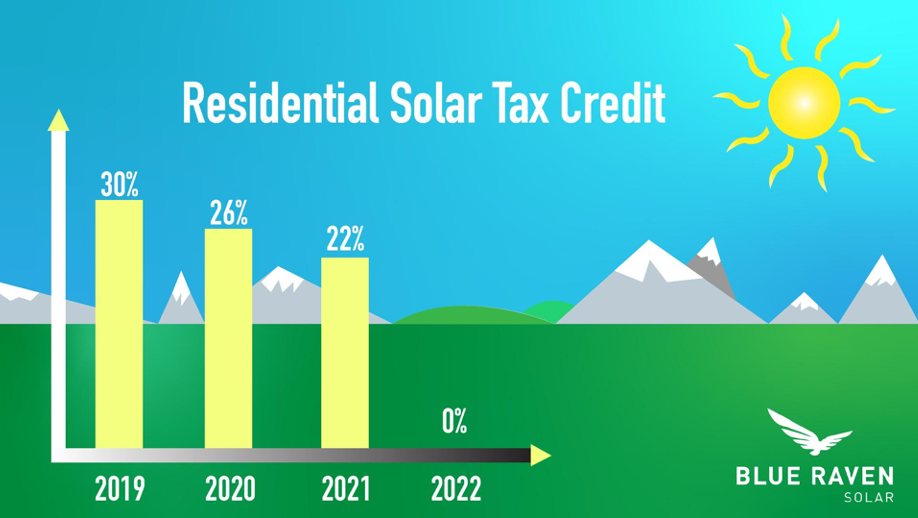

Residential Arizona Solar Tax Credit. The 30 credit will only last only through 2019. The federal solar investment tax credit will have the biggest impact on the cost you will face to go solar in Arizona.

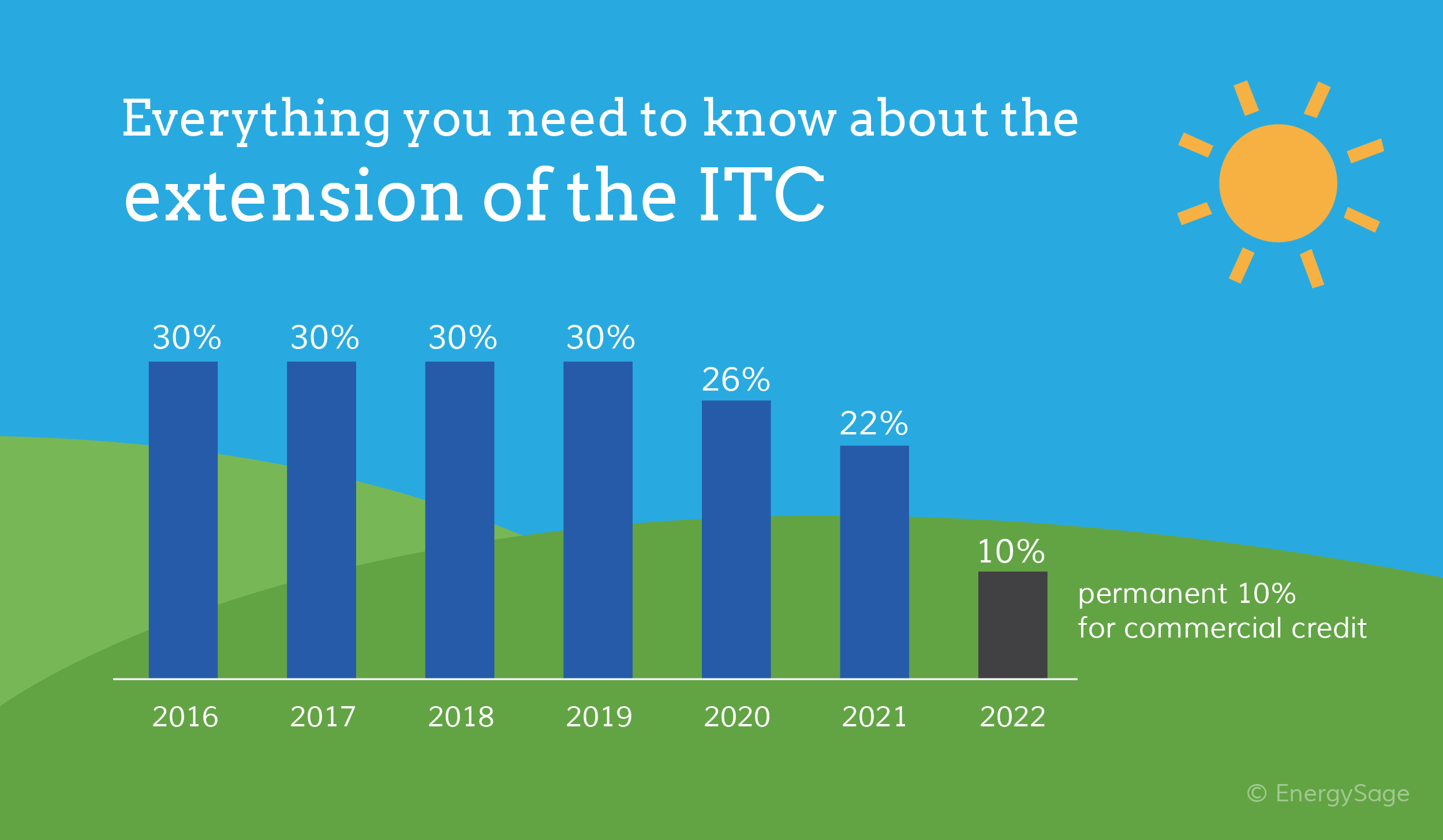

Arizonas tax credit for solar and wind installations in commercial and industrial applications was established in June 2006. The solar tax credit is currently available at a rate of 26 through 2022 then at 22 for construction projects that begin in 2023. This means that in 2017 you can still get a major discounted price for your.

23 rows Did you install solar panels on your house. The residential ITC drops to 22 in 2023 and. You can qualify for the ITC as long as your solar system is new or being used for the first time between January 1 2006 and December 31 2023.

Other solar tax benefits throughout Arizona. Summary of solar rebates in Arizona. 2491 to extend the credit.

The amount represents 25 percent. Arizona Department of Revenue tax credit. Arizona State Energy Tax Credits.

This perk is commonly known as the. With the Investment Tax Credit ITC you can reduce the cost of your PV solar energy system by 26 percentKeep in. The Residential Arizona Solar Tax Credit gives you back 25 of the cost of your solar panel installation up to 1000 off of your income tax return in.

Arizonians who install solar panels on their property have access to. Arizonas Solar Energy Credit is available to individual taxpayers who install a solar or wind energy device at the taxpayers Arizona residence. Arizona will give a business a tax credit for 10 of the system cost up to 25000 for any one building in the same year and 50000 per business in total credits in one year.

The 26 federal solar tax credit is available for purchased home solar systems installed by. Check out all of the Arizona solar tax credits rebates and incentives. In May 2007 the credit was revised by HB.

Under this credit system you can receive a tax credit for 26 percent of. Arizona residents are offered a wood stove deduction for qualifying residential systems that is good to a maximum amount of 500 on wood heater purchase and installation. Arizona offers state solar tax credits -- 25 of the total system cost up to 1000.

Ad Step 1 - Enter ZipCode for the Best Powerhome Solar Pricing Now. The federal Investment Tax Credit ITC is one of the major reasons many people choose to go solar. Worth 26 of the gross system cost through 2020.

A nonrefundable individual tax credit for an individual who installs a solar energy device in taxpayers residence located in. One of the most significant solar incentives you can take advantage of in 2021 is the Federal Solar Tax Credit ITC. It slashes the cost of your installation by nearly a third via a 30 tax.

The credit is allowed against the. The Residential Arizona Solar Tax Credit gives you back 25 of the cost of your. The residential tax credit is reduced to nothing in.

Federal solar investment tax credit. Solar Incentives At A Glance. Solar Tax Credit Eligibility.

This 75 credit is provided for in Arizona Revised Statutes 43-1090 and 43. As a credit you take the amount directly off your tax payment rather than as. An Arizona state tax credit up to 100000 A 26 federal solar tax credit.

Low Cost Powerhome Solar Options for Less - Hire the Right Pro Today and Save. An individual or corporate income tax credit is available for taxpayers who own a qualified energy generator that first produces electricity before Jan. Buy and install a new home solar system in Arizona in 2021 with or without a home battery and you could qualify for the 26 federal tax credit.

Dont forget about federal solar incentives. Read User Reviews See Our. No APS does not offer any solar incentives or rebates.

The federal solar tax credit. It is valid the year of installation only. Incentives for homeowners to make the switch to solar have historically been offered at the federal state and local Arizona utilities levels.

However the state of Arizona does offer a tax credit that can be used on top of the federal solar tax credit. The Arizona Solar Tax Credit lets you deduct up to 1000 from your personal Arizona income taxes.

Is Solar Worth It In Arizona Solar Panels Savings Az Solar Website

Pricing Incentives Guide To Solar Panels In Arizona 2022 Forbes Home

Solar Tax Credit 2021 Extension What You Need To Know Energysage

Arizona Solar Incentives Arizona Solar Rebates Tax Credits

Is Solar Worth It In Arizona Solar Panels Savings Az Solar Website

Cost Of Solar Panels In Arizona 2022 Tips To Saving Money

Arizona Solar Incentives And Rebates 2022 Solar Metric

Federal Solar Tax Credit A Homeowner S Guide 2022 Updated

Solar Tax Credit Pays For Solar Yuma Solar Pros 48solar

Cost Of Solar Panels In Arizona 2022 Tips To Saving Money

The Extended 26 Solar Tax Credit Critical Factors To Know

2022 Arizona Solar Incentives Tax Credits Rebates And More

Solar Tax Credit In 2021 Southface Solar Electric Az

Free Solar Panels Arizona What S The Catch How To Get

Arizona Solar Tax Credits And Incentives Guide 2022

The Federal Solar Tax Credit Energy Solution Providers Arizona