do closed end funds have liquidity risk

That is closed-end fund shares generally are not redeemable. Web After the market closes the fund company adds the value of every asset in the fund gets the total NAV and divides by the number of shares.

Key Concepts Of Closed End Funds Nuveen

Web One thing that closed-end and open-end funds have in common.

. Their yields range from 632 on average for bond CEFs to 722 for the average stock CEF. Web Closed-end funds CEFs can be one solution with yields averaging 673. Web George uses the following investment strategies1 Opportunistic Closed-end fund investing.

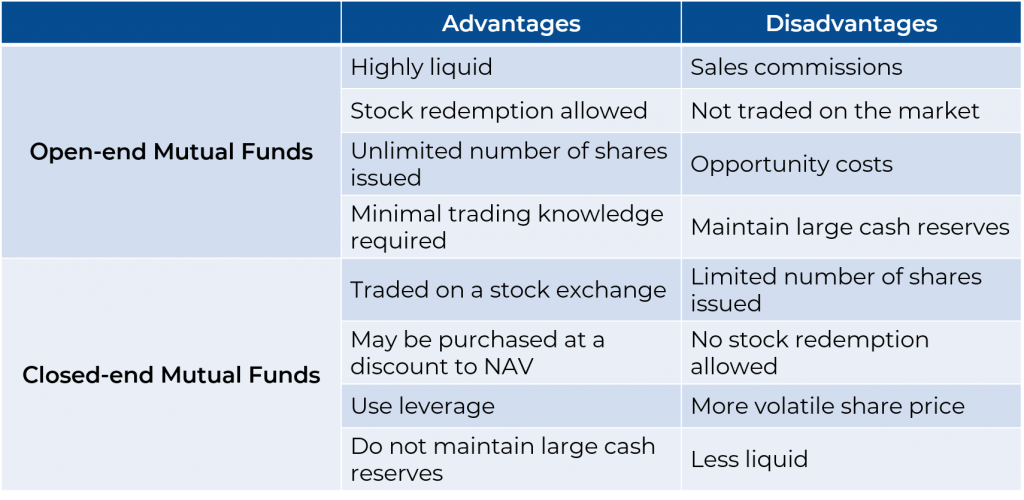

01 2022 GLOBE NEWSWIRE -- The Boards of TrusteesDirectors of the PIMCO closed-end funds below each a Fund and collectively. Web Less known and understood closed-end mutual funds or closed-end funds CEFs can offer investors more compelling opportunities but pose greater risks than open-end mutual. CEFs are exposed to much of the same risk as other exchange traded products including liquidity risk on the.

Web Non-listed closed-end funds and business development companies do not offer investors daily liquidity but rather offer liquidity on a monthly quarterly or semi-annual basis often. This can be a retail product for those who can stomach the associated risks in. Web Unlisted closed-end funds also provide limited liquidity.

Web A closed-end fund generally is not required to buy its shares back from investors upon request. Web A closed end fund is just like a mutual fund or an exchange traded fund in that a manager buys and sells investments and investors can buy an ownership stake in the. Web CEFs are just as exposed to the various external risks as other exchange-traded investments including liquidity risk on the secondary market credit risk concentration risk and.

Web Although there are no required minimums closed-end funds are not for every investor. Buy CEFs at larger than normal discounts to NAV and sell them when the. White explained that the proposed recommendation sets forth a strong versatile proposal to enhance liquidity risk.

Web Non-listed closed-end funds and business development companies do not offer investors daily liquidity but rather offer liquidity on a monthly quarterly or semi-annual basis often. November 2 2022 The Securities and Exchange Commission today voted to propose amendments to better prepare open-end. Web Washington DCNewsfile Corp.

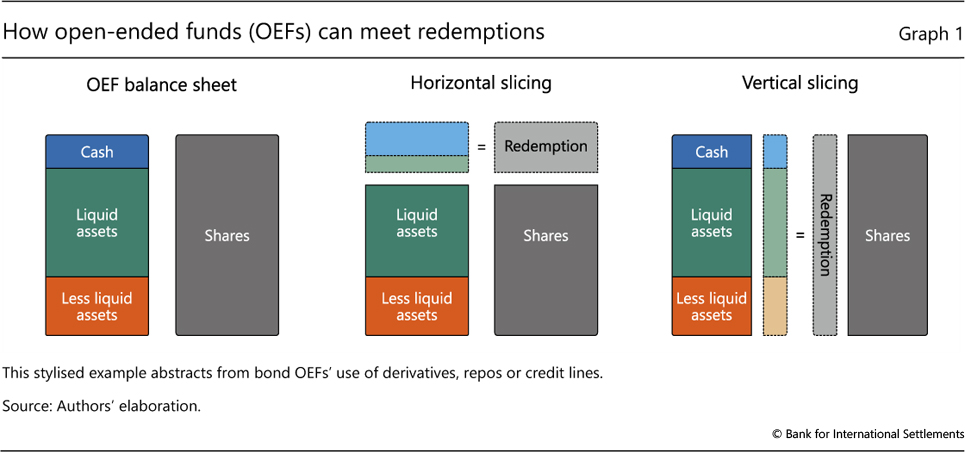

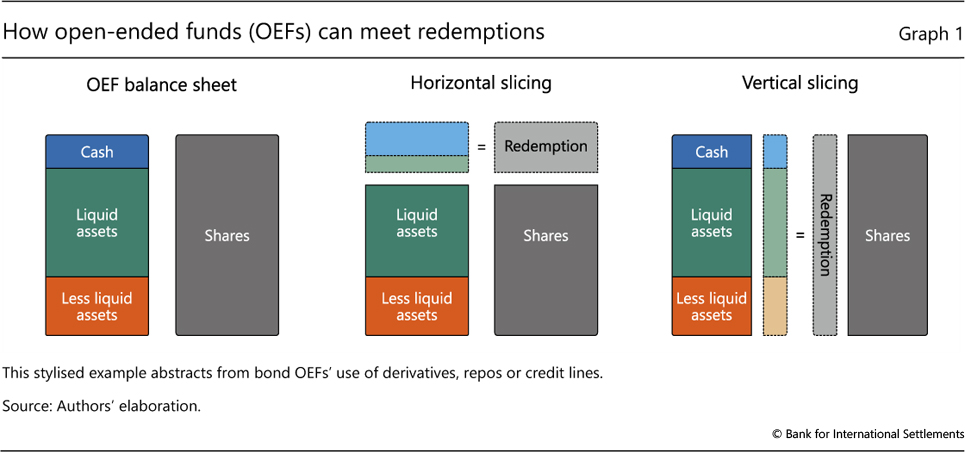

Web Closed-end funds may trade above or below the funds net asset value based on supply and demand for the funds shares and other technical factors. Web Open-end funds though have an underlying structural liquidity mismatch. When you buy and sell your.

Web NEW YORK Nov. Web the majority of closed-end funds specialize in illiquid securities such as municipal corporate and international bonds while CEFs are themselves relatively liquid. Closed-end funds provide investors the ability to buy discounted assets on the cheap and amplify.

Web Manzler 2004 shows that the discounts on closed-end funds are driven by both liquidity and liquidity risk differentials between the fund stocks and the stocks in the. Web Certain closed-end funds may invest without limitation in illiquid or less liquid investments or investments in which no secondary market is readily available or which are otherwise. Web all funds adequately manage liquidity risk.

Most closed-end funds are actively managed and charge relatively high fees compared to index. Web Closed-end funds are considered a riskier choice because. This can raise issues for investor protection our capital markets and the broader economy.

Investing In Mutual Funds Commodities Real Estate And Collectibles

Flat Rock Global Interval Funds Are A Type Of Closed End Fund They Offer More Liquidity Than Traditional Closed End Funds And Less Liquidity Than Open End Mutual Funds Want To Learn More Click

Real Estate Cefs Satisfying A High Yield Fix Seeking Alpha

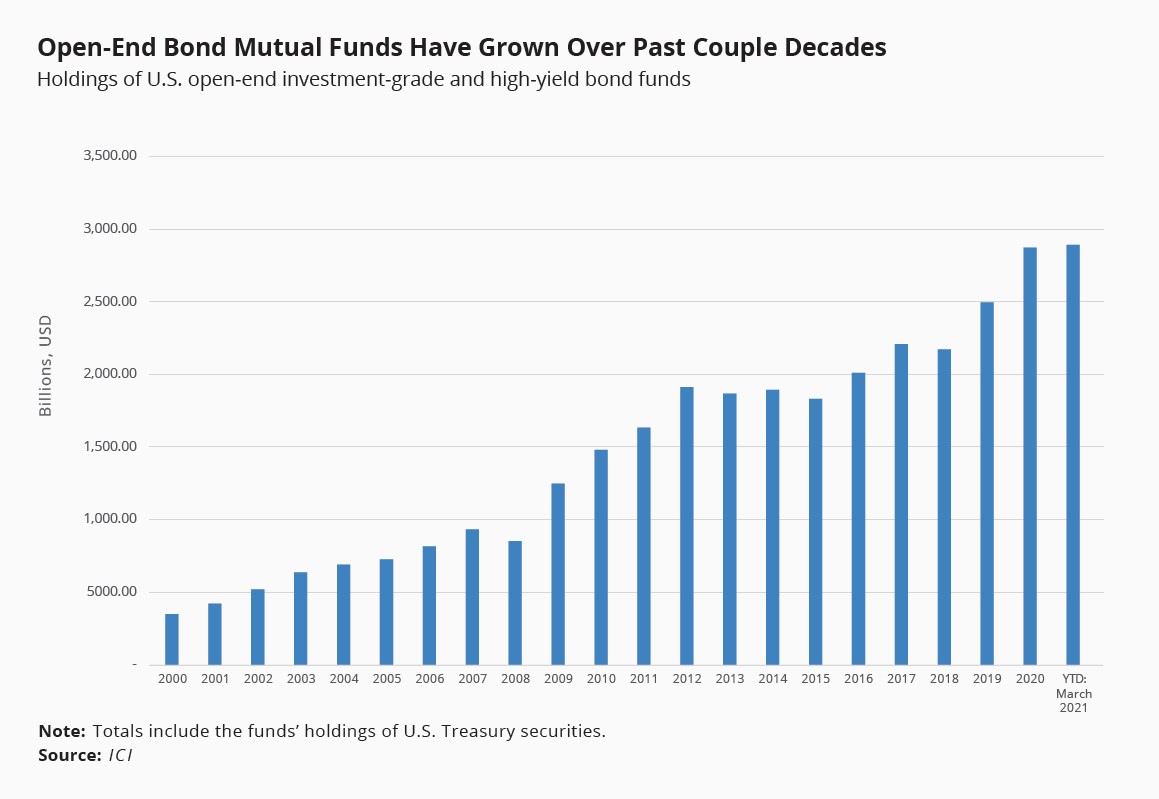

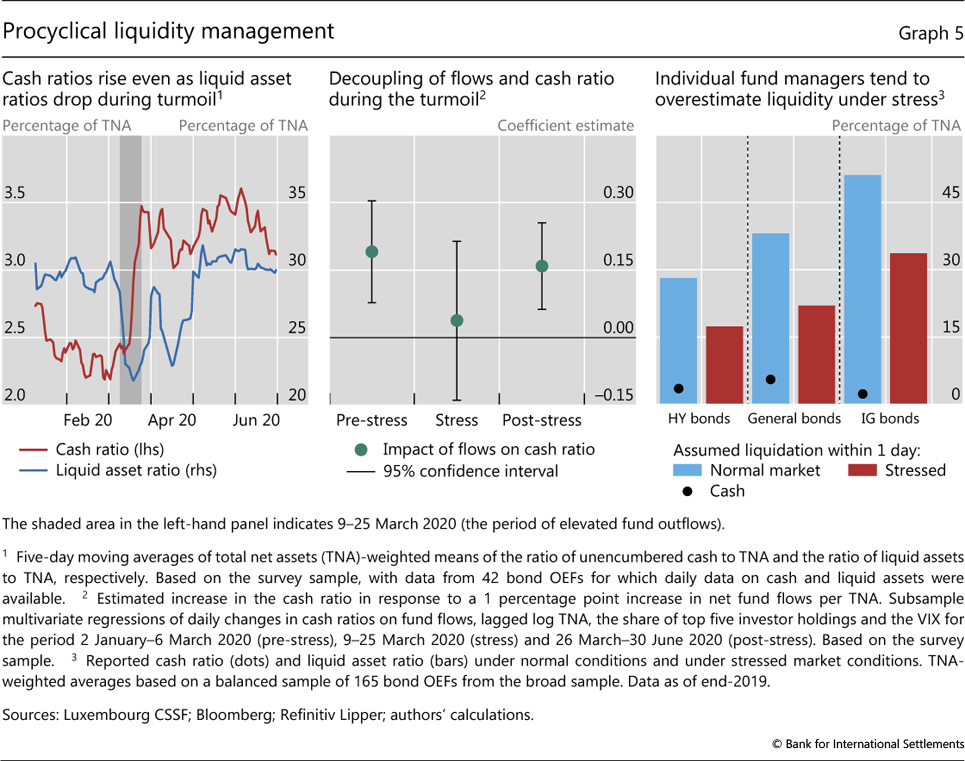

Open Ended Bond Funds Systemic Risks And Policy Implications

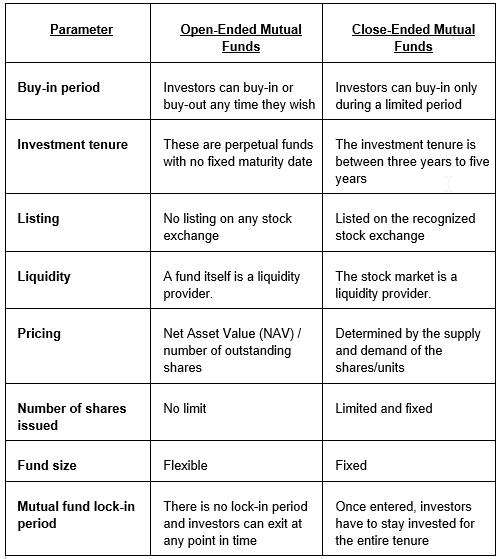

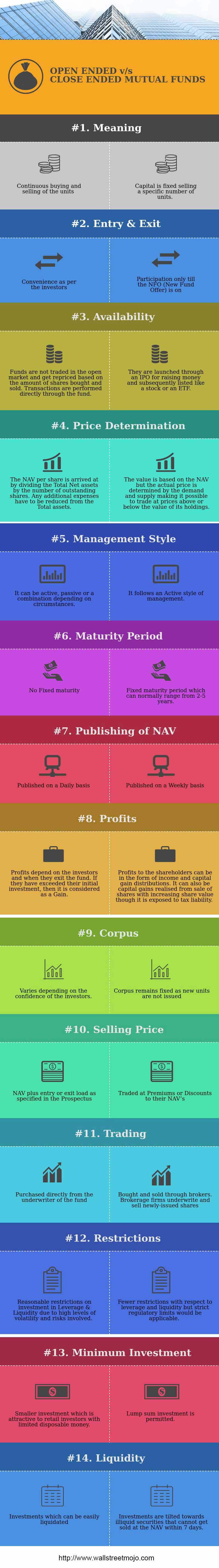

Open Ended Vs Closed Ended Mutual Funds Top 14 Differences

Navigating Mutual Funds In Rough Markets Liquidity Asset Management Advocate

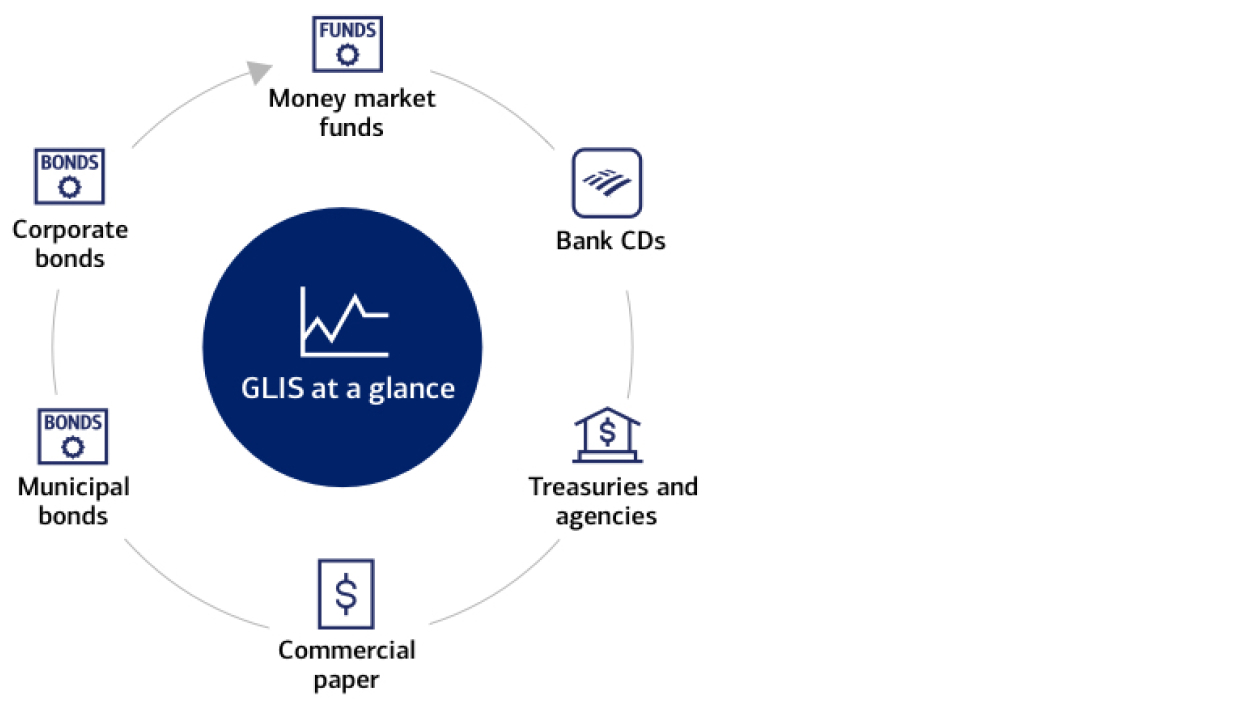

Glis Global Liquidity Investment Solutions From Bofa Securities

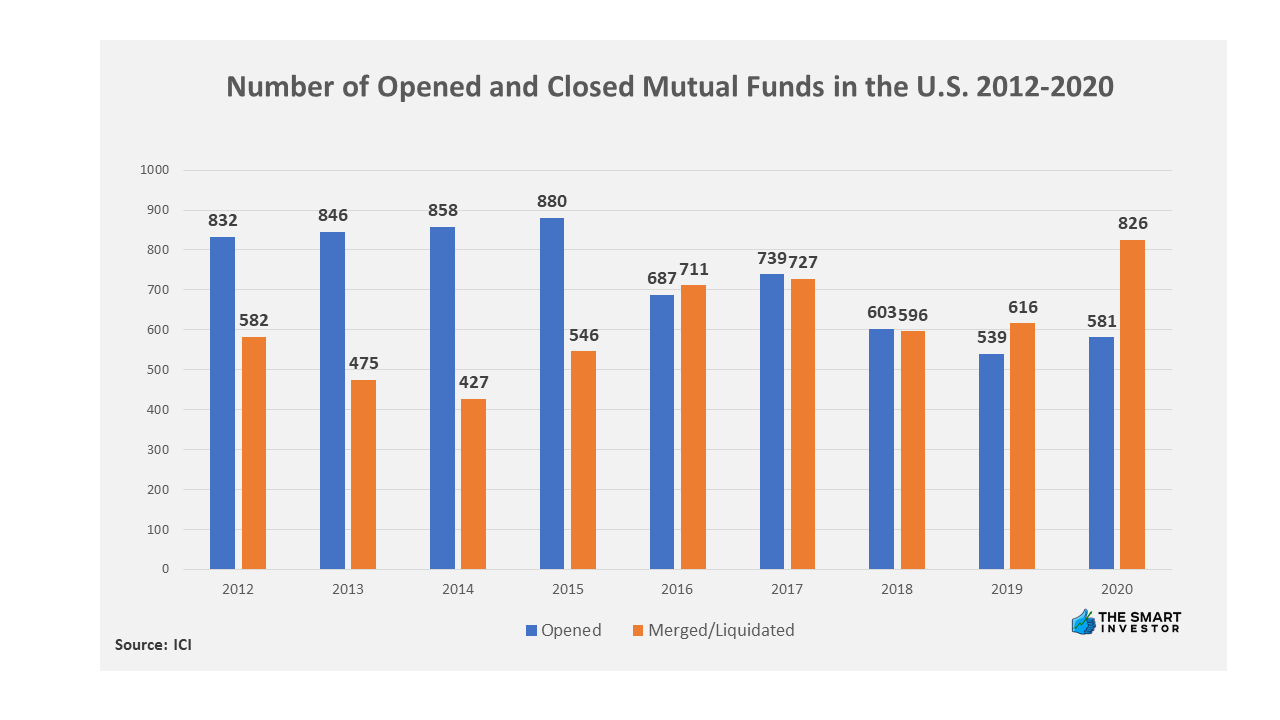

Closed End Funds Basics How It Works Pros Cons The Smart Investor

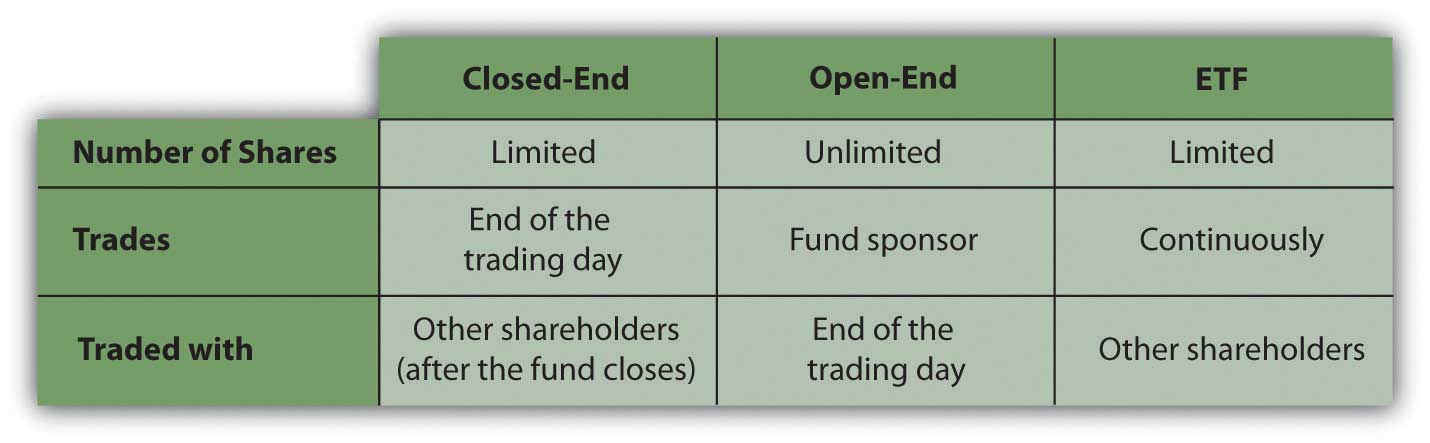

What Are Mutual Funds 365 Financial Analyst

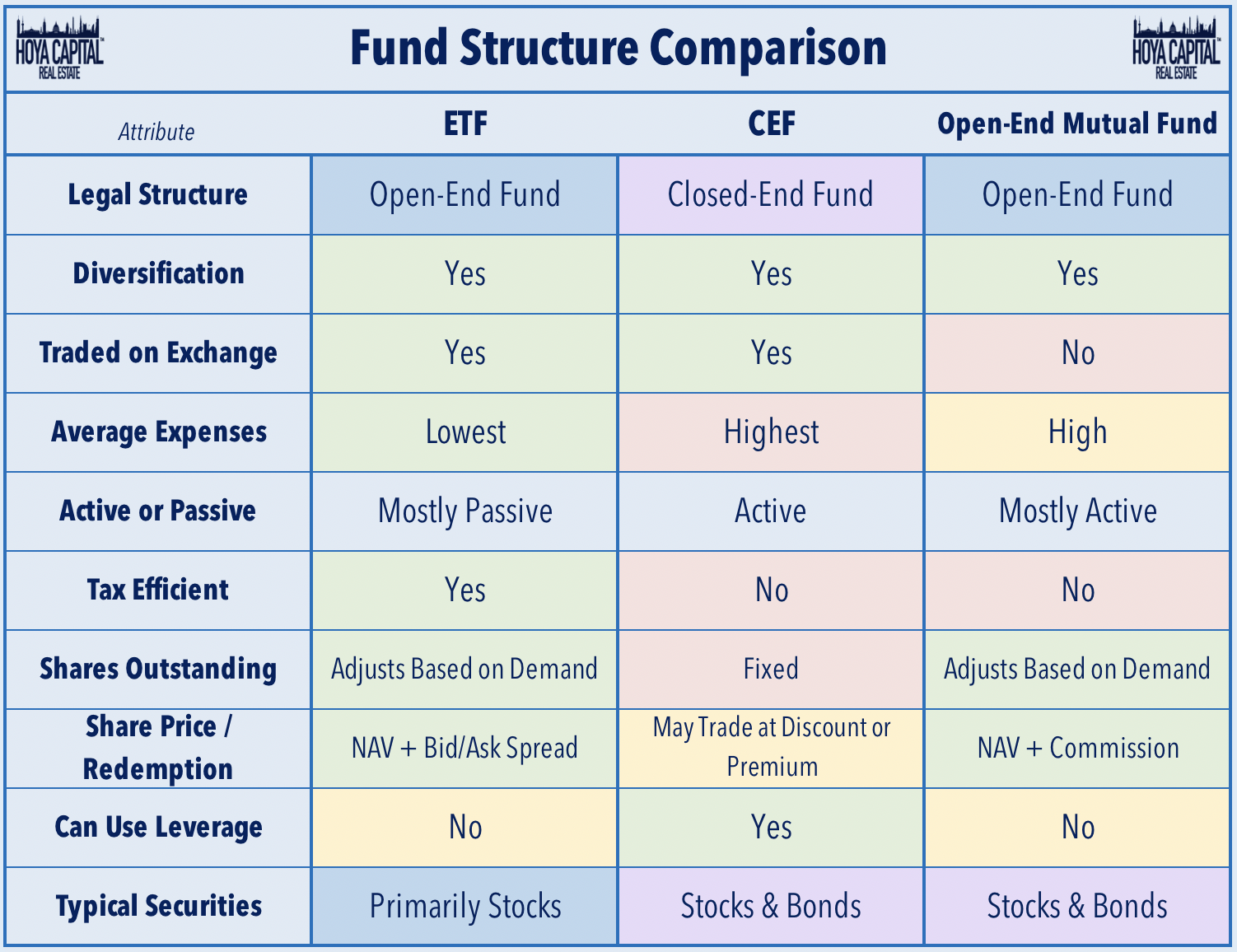

Is Etf A Closed Ended Or An Open Ended Fund Quora

Open Ended Mutual Funds Meaning Benefits Open Vs Close Ended Funds

What Are Closed End Funds Forbes Advisor

Public Investment Funds Laws And Regulations Report 2022 Usa

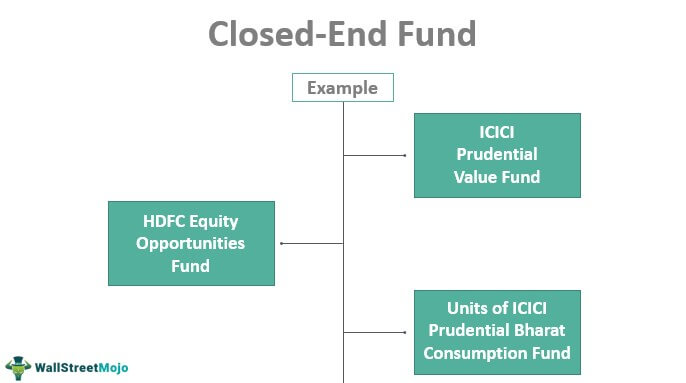

Closed End Fund Definition Examples How It Works

What Is The Difference Between Closed And Open Ended Funds Quora

Open Ended Bond Funds Systemic Risks And Policy Implications

Investment Management Update Insights Skadden Arps Slate Meagher Flom Llp